Fake online reviews generated by unscrupulous marketers blanket the Internet these days. Although online review pollution isn’t exactly a hot-button consumer issue, there are plenty of cases in which phony reviews may endanger one’s life or well-being. This is the story about how searching for drug abuse treatment services online could cause concerned loved ones to send their addicted, vulnerable friends or family members straight into the arms of the Church of Scientology.

As explained in last year’s piece, Don’t Be Fooled by Fake Online Reviews Part II, there are countless real-world services that are primed for exploitation online by marketers engaged in false and misleading “search engine optimization” (SEO) techniques. These shady actors specialize in creating hundreds or thousands of phantom companies online, each with different generic-sounding business names, addresses and phone numbers. The phantom firms often cluster around fake listings created in Google Maps — complete with numerous five-star reviews, pictures, phone numbers and Web site links.

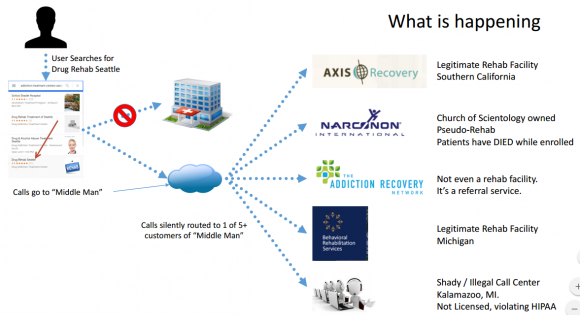

The problem is that calls to any of these phony companies are routed back to the same crooked SEO entity that created them. That marketer in turn sells the customer lead to one of several companies that have agreed in advance to buy such business leads. As a result, many consumers think they are dealing with one company when they call, yet end up being serviced by a completely unrelated firm that may not have to worry about maintaining a reputation for quality and fair customer service.

Experts say fake online reviews are most prevalent in labor-intensive services that do not require the customer to come into the company’s offices but instead come to the consumer. These services include but are not limited to locksmiths, windshield replacement services, garage door repair and replacement technicians, carpet cleaning and other services that consumers very often call for immediate service.

As it happens, the problem is widespread in the drug rehabilitation industry as well. That became apparent after I spent just a few hours with Bryan Seely, the guy who literally wrote the definitive book on fake Internet reviews.

Perhaps best known for a stunt in which he used fake Google Maps listings to intercept calls destined for the FBI and U.S. Secret Service, Seely knows a thing or two about this industry: Until 2011, he worked for an SEO firm that helped to develop and spread some of the same fake online reviews that he is now helping to clean up.

More recently, Seely has been tracking a network of hundreds of phony listings and reviews that lead inquiring customers to fewer than a half dozen drug rehab centers, including Narconon International — an organization that promotes the theories of Scientology founder L. Ron Hubbard regarding substance abuse treatment and addiction.

As described in Narconon’s Wikipedia entry, Narconon facilities are known not only for attempting to win over new converts, but also for treating all drug addictions with a rather bizarre cocktail consisting mainly of vitamins and long hours in extremely hot saunas. The Wiki entry documents multiple cases of accidental deaths at Narconon facilities, where some addicts reportedly died from overdoses of vitamins or neglect:

“Narconon has faced considerable controversy over the safety and effectiveness of its rehabilitation methods,” the Wiki entry reads. “Narconon teaches that drugs reside in body fat, and remain there indefinitely, and that to recover from drug abuse, addicts can remove the drugs from their fat through saunas and use of vitamins. Medical experts disagree with this basic understanding of physiology, saying that no significant amount of drugs are stored in fat, and that drugs can’t be ‘sweated out’ as Narconon claims.”

FOLLOW THE BOUNCING BALL

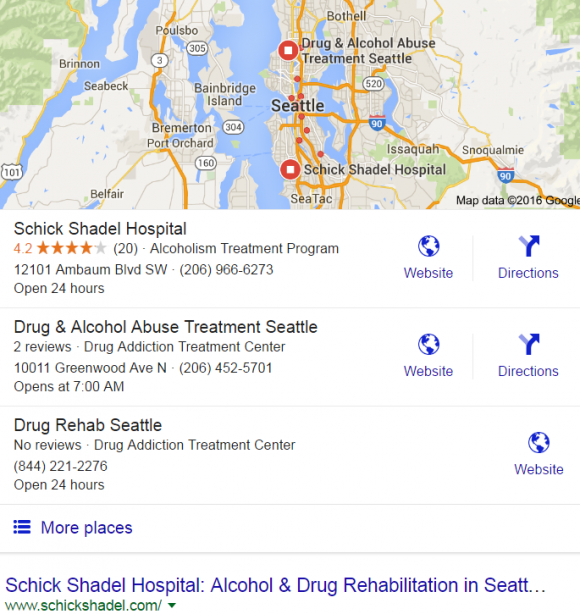

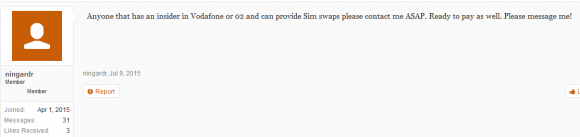

Seely said he learned that the drug rehab industry was overrun with SEO firms when he began researching rehab centers in Seattle for a family friend who was struggling with substance abuse and addiction issues. A simple search on Google for “drug rehab Seattle” turned up multiple local search results that looked promising.

One of the top three results was for a business calling itself “Drug Rehab Seattle,” and while it lists a toll-free phone number, it does not list a physical address (NB: this is not always the case with fake listings, which just as often claim the street address of another legitimate business). A click on the organization’s listing claims the Web site rehabs.com – a legitimate drug rehab search service. However, the owners of rehabs.com say this listing is unauthorized and unaffiliated with rehabs.com.

As documented in this Youtube video, Seely called the toll-free number in the Drug Rehab Seattle listing, and was transferred to a hotline that took down his name, number and insurance information and promised an immediate call back. Within minutes, Seely said, he received a call from a woman who said she represented a Seattle treatment center but was vague about the background of the organization itself. A little digging showed that the treatment center was run by Narconon.

“You’re supposed to be getting a local drug rehab in Seattle, but instead you get taken to a call center, which can be owned by any number of rehab facilities around the country that pay legitimate vendors for calls,” Seely said. “If you run a rehab facility, you have to get people in the doors to make money. The guy who created these fake listings figured out you can use Google Maps to generate leads, and it’s free.”

The phony rehab establishment listed here is the third listing, which includes no physical address and routes the caller to a referral network that sells leads to Narconon, among others.

Here’s the crux of the problem: When you’re at Google.com and you search for something that Google believes to be a local search, Google adds local business results on top of the organic search results — complete with listings and reviews associated with Google Maps. Consumers might not even read them, but reviews left for businesses in this listings heavily influence their search rankings. The more reviews a business has, Seely said, the closer it gets to the coveted Number One spot in the search rankings.

That #1 rank attracts the most calls by a huge margin, and it can mean huge profits: Many rehab facilities will pay hundreds of dollars for leads that may ultimately lead to a new patient. After all, some facilities can then turn around and bill insurance providers for tens of thousands of dollars per patient.

WHO IS JOHN HARVEY?

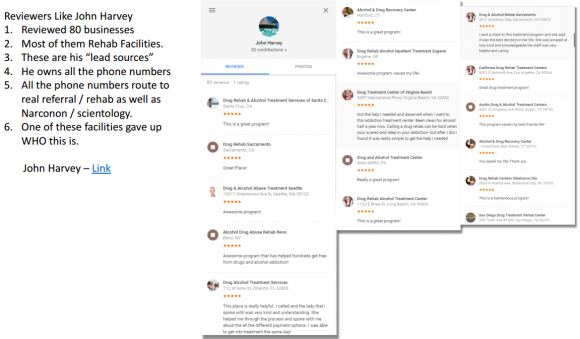

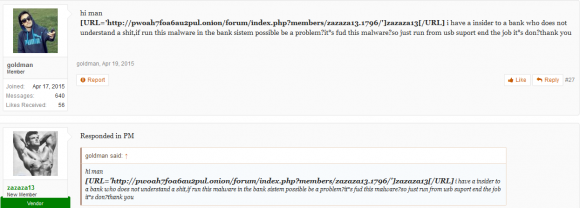

Curious if he could track down the company or individual behind the phony review that prompted a call from Narconon, Seely began taking a closer look at the reviews for the facility he called. One reviewer in particular stood out — one “John Harvey,” a Google user who clearly has a great deal of experience with rehab centers.

A click on John Harvey’s Google Plus profile showed he reviewed no fewer than 82 phantom drug treatment centers around the country, offering very positive 5-star reviews on all of them. A brief search for John Harvey online shows that the person behind the account is indeed a guy named John Harvey from Sacramento who runs an SEO company in Kuilua, Hawaii called TopSeek Inc., which bills itself as a collection of “local marketing experts.”

A visit to the company’s Web site shows that Narconon is among four of TopSeek’s listed clients, all of which either operate drug rehab centers or are in the business of marketing drug rehab centers.

TopSeek Inc’s client list includes Narconon, a Scientology front group that seeks to recruit new members via a network of unorthodox drug treatment facilities.

Calls and emails to Mr. Harvey went unreturned, but it’s clear he quickly figured out that the jig was up: Just hours after KrebsOnSecurity reached out to Mr. Harvey for comment, all of his phony addiction treatment center reviews mysteriously disappeared (some of the reviews are preserved in the screenshot below).

“This guy is sitting in Hawaii saying he’s retired and that he’s not taking any more clients,” Seely said. “Well, maybe he’s going to have to come out of retirement to go into prison, because he’s committed fraud in almost every state.”

While writing fake online reviews may not be strictly illegal or an offense that could send one to jail, several states have begun cracking down on “reputation management” and SEO companies that engage in writing or purchasing fake reviews. However, it’s unclear whether the fines being enforced for violations will act as a deterrent, since those fines are likely a fraction of the revenues that shady SEO companies stand gain by engaging in this deceptive practice.

WHAT YOU CAN DO ABOUT FAKE ONLINE REVIEWS

Before doing business with a company you found online, don’t just pick the company that comes up tops in the search results on Google. Unfortunately, that generally guarantees little more than the company is good at marketing.

Take the time to research the companies you wish to hire before booking them for jobs or services, especially when it comes to big, expensive, and potentially risky services like drug rehab or moving companies. By the way, if you’re looking for a legitimate rehab facility, you could do worse than to start at the aforementioned rehabs.com, a legitimate rehab search engine.

It’s a good idea to get in the habit of verifying that the organization’s physical address, phone number and Web address shown in the search result match that of the landing page. If the phone numbers are different, use the contact number listed on the linked site.

Take the time to learn about the organization’s reputation online and in social media; if it has none (other than a Google Maps listing with all glowing, 5-star reviews), it’s probably fake. Search the Web for any public records tied to the business’ listed physical address, including articles of incorporation from the local secretary of state office online. A search of the company’s domain name registration records can give you an idea of how long its Web site has been in business, as well as additional details about the company and/or the organization itself.

Seely said one surefire way to avoid these marketing shell games is to ask a simple question of the person who answers the phone in the online listing.

“Ask anyone on the phone what company they’re with,” Seely said. “Have them tell you, take their information and then call them back. If they aren’t forthcoming about who they are, they’re most likely a scam.”

For the record, I requested comment on this story from Google — and specifically from the people at Google who handle Google Maps — but have yet to hear back from them. I’ll update this story in the event that changes.

from

http://redirect.viglink.com?u=http%3A%2F%2Fkrebsonsecurity.com%2F2016%2F06%2Fscientology-seeks-captive-converts-via-google-maps-drug-rehab-centers%2F&key=ddaed8f51db7bb1330a6f6de768a69b8

Owned by Santa Clara, Calif. based networking giant

Owned by Santa Clara, Calif. based networking giant  The latest update brings Flash to v. 22.0.0.192 for Windows and Mac users alike. If you have Flash installed, you should update, hobble or remove Flash as soon as possible.

The latest update brings Flash to v. 22.0.0.192 for Windows and Mac users alike. If you have Flash installed, you should update, hobble or remove Flash as soon as possible. According to

According to  FBI Special Agent Timothy J. Wilkins wrote that investigators also subpoenaed and got access to that michaelp77x@gmail.com account, and found emails between Persaud and at least four affiliate programs that hire spammers to send junk email campaigns.

FBI Special Agent Timothy J. Wilkins wrote that investigators also subpoenaed and got access to that michaelp77x@gmail.com account, and found emails between Persaud and at least four affiliate programs that hire spammers to send junk email campaigns. Yes, that’s right it’s once again Patch Tuesday, better known to mere mortals as the second Tuesday of each month. Microsoft isn’t kidding around this particular Tuesday — pushing out

Yes, that’s right it’s once again Patch Tuesday, better known to mere mortals as the second Tuesday of each month. Microsoft isn’t kidding around this particular Tuesday — pushing out

During the height of tax-filing season in 2015, KrebsOnSecurity

During the height of tax-filing season in 2015, KrebsOnSecurity  On January 27, 2016, this publication was the first

On January 27, 2016, this publication was the first

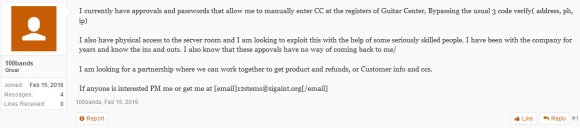

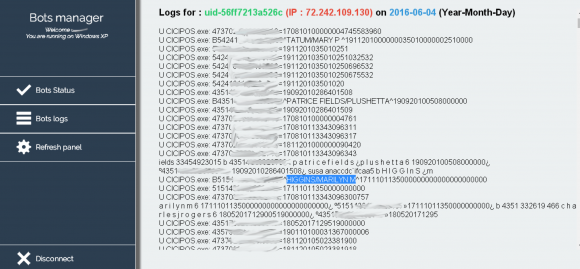

Over the past two months, KrebsOnSecurity has received inquiries from fraud fighters at more than a half-dozen financial institutions in the United States — all asking if I had any information about a possible credit card breach at CiCi’s. Every one of these banking industry sources said the same thing: They’d detected a pattern of fraud on cards that all had one thing in common: They’d all been used in the last few months at various CiCi’s Pizza locations.

Over the past two months, KrebsOnSecurity has received inquiries from fraud fighters at more than a half-dozen financial institutions in the United States — all asking if I had any information about a possible credit card breach at CiCi’s. Every one of these banking industry sources said the same thing: They’d detected a pattern of fraud on cards that all had one thing in common: They’d all been used in the last few months at various CiCi’s Pizza locations.