A 28-year-old Kansas man was shot and killed by police officers on the evening of Dec. 28 after someone fraudulently reported a hostage situation ongoing at his home. The false report was the latest in a dangerous hoax known as “swatting,” wherein the perpetrator falsely reports a dangerous situation at an address with the goal of prompting authorities to respond to that address with deadly force. This particular swatting reportedly originated over a $1.50 wagered match in the online game Call of Duty. Compounding the tragedy is that the man killed was an innocent party who had no part in the dispute.

The following is an analysis of what is known so far about the incident, as well as a brief interview with the alleged and self-professed perpetrator of this crime.

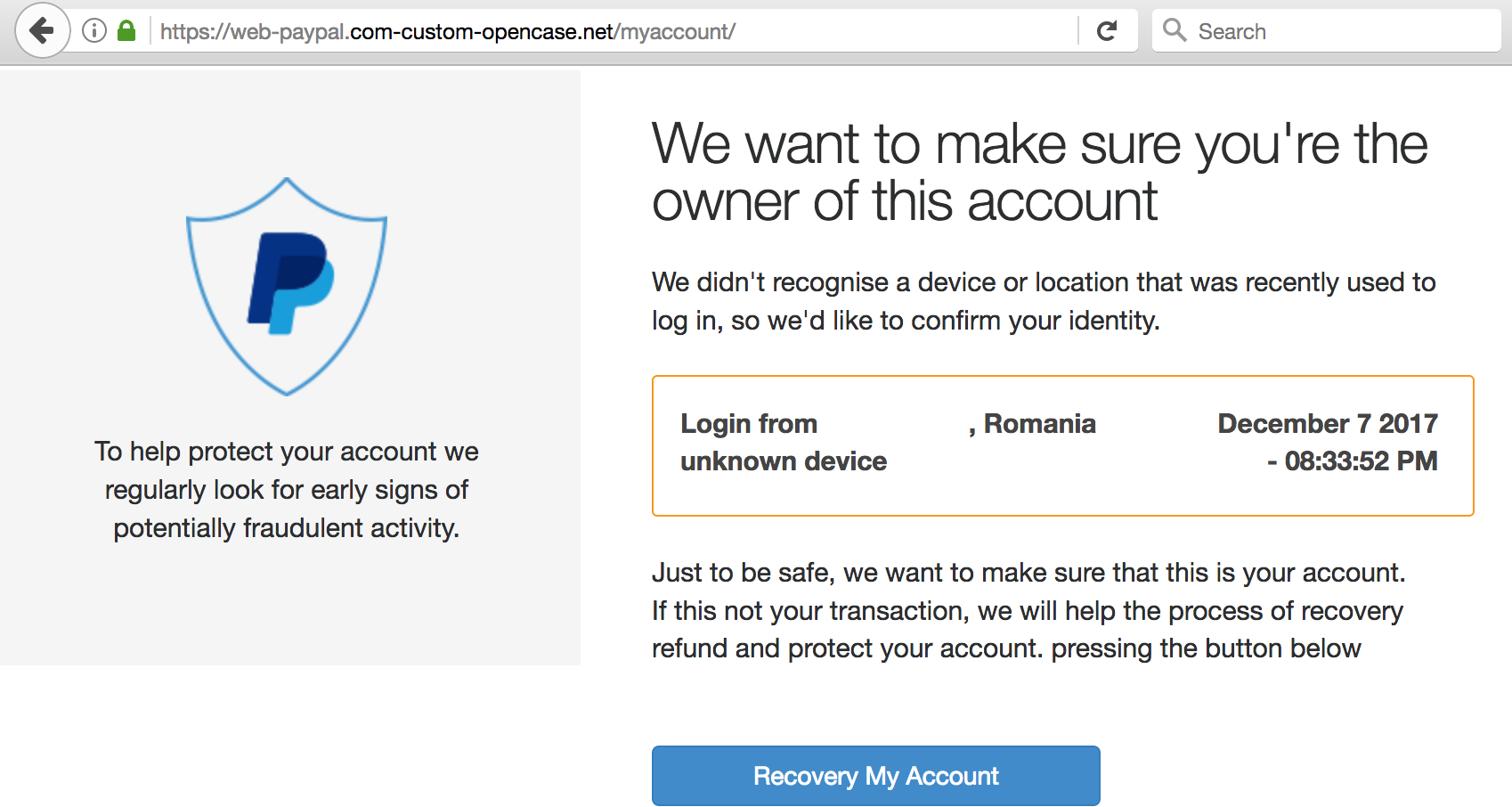

It appears that the dispute and subsequent taunting originated on Twitter. One of the parties to that dispute — allegedly using the Twitter handle “SWauTistic” — threatened to swat another user who goes by the nickname “7aLeNT“. @7aLeNT dared someone to swat him, but then tweeted an address that was not his own.

Swautistic responded by falsely reporting to the Kansas police a domestic dispute at the address 7aLenT posted, telling the authorities that one person had already been murdered there and that several family members were being held hostage.

Image courtesey @mattcarries

A story in the Wichita Eagle says officers responded the 1000 block of McCormick and got into position, preparing for a hostage situation.

“A male came to the front door,” Livingston said. “As he came to the front door, one of our officers discharged his weapon.”

“Livingston didn’t say if the man, who was 28, had a weapon when he came to the door, or what caused the officer to shoot the man. Police don’t think the man fired at officers, but the incident is still under investigation, he said. The man, who has not been identified by police, died at a local hospital.

“A family member identified that man who was shot by police as Andrew Finch. One of Finch’s cousins said Finch didn’t play video games.”

Not long after that, Swautistic was back on Twitter saying he could see on television that the police had fallen for his swatting attack. When it became apparent that a man had been killed as a result of the swatting, Swautistic tweeted that he didn’t get anyone killed because he didn’t pull the trigger (see image above).

Swautistic soon changed his Twitter handle to @GoredTutor36, but KrebsOnSecurity managed to obtain several weeks’ worth of tweets from Swautistic before his account was renamed. Those tweets indicate that Swautistic is a serial swatter — meaning he has claimed responsibility for a number of other recent false reports to the police.

Among the recent hoaxes he’s taken credit for include a false report of a bomb threat at the U.S. Federal Communications Commission (FCC) that disrupted a high-profile public meeting on the net neutrality debate. Swautistic also has claimed responsibility for a hoax bomb threat that forced the evacuation of the Dallas Convention Center, and another bomb threat at a high school in Panama City, Fla, among others.

After tweeting about the incident extensively this afternoon, KrebsOnSecurity was contacted by someone in control of the @GoredTutor36 Twitter account. GoredTutor36 said he’s been the victim of swatting attempts himself, and that this was the reason he decided to start swatting others.

He said the thrill of it “comes from having to hide from police via net connections.” Asked about the FCC incident, @GoredTutor36 acknowledged it was his bomb threat. “Yep. Raped em,” he wrote.

“Bomb threats are more fun and cooler than swats in my opinion and I should have just stuck to that,” he wrote. “But I began making $ doing some swat requests.”

Asked whether he feels remorse about the Kansas man’s death, he responded “of course I do.”

But evidently not enough to make him turn himself in.

“I won’t disclose my identity until it happens on its own,” the user said in a long series of direct messages on Twitter. “People will eventually (most likely those who know me) tell me to turn myself in or something. I can’t do that; though I know its [sic] morally right. I’m too scared admittedly.”

ANALYSIS

As a victim of my own swatting attack back in 2013, I’ve been horrified to watch these crimes only increase in frequency ever since — usually with little or no repercussions on the part of the person or persons involved in setting the schemes in motion. Given that the apparent perpetrator of this crime seems eager for media attention, it seems likely he will be apprehended soon. My guess is that he is a minor and will be treated with kid gloves as a result, although I hope I’m wrong on both counts.

Let me be crystal clear on a couple of points. First off, there is no question that police officers and first responders across the country need a great deal more training to bring the number of police shootings way down. That is undoubtedly a giant contributor to the swatting epidemic.

Also, all police officers and dispatchers need to be trained on what swatting is, how to spot the signs of a hoax, and how to minimize the risk of anyone getting harmed when responding to reports about hostage situations or bomb threats. Finally, officers of the peace who are sworn to protect and serve should use deadly force only in situations where there is a clear and immediate threat. Those who jump the gun need to be held accountable as well.

But that kind of reform isn’t going to happen overnight. Meanwhile, knowingly and falsely making a police report that results in a SWAT unit or else heavily armed police response at an address is an invitation for someone to get badly hurt or killed. These are high-pressure situations and in most cases — as in this incident — the person opening the door has no idea what’s going on. Heaven protect everyone at the scene if the object of the swatting attack is someone who is already heavily armed and confused enough about the situation to shoot anything that comes near his door.

In some states, filing a false police report is just a misdemeanor and is mainly punishable by fines. However, in other jurisdictions filing a false police report is a felony, and I’m afraid it’s long past time for these false reports about dangerous situations to become a felony offense in every state. Here’s why.

If making a fraudulent report about a hostage situation or bomb threat is a felony, then if anyone dies as a result of that phony report they can legally then be charged with felony murder. Under the doctrine of felony murder, when an offender causes the death of another (regardless of intent) in the commission of a dangerous crime, he or she is guilty of murder.

Too often, however, the perpetrators of these crimes are minors, and even when they’re caught they are frequently given a slap on the wrist. Swatting needs to stop, and unfortunately as long as there are few consequences for swatting someone, it will continue to be a potentially deadly means for gaining e-fame and for settling childish and pointless ego squabbles.

from

https://krebsonsecurity.com/2017/12/kansas-man-killed-in-swatting-attack/

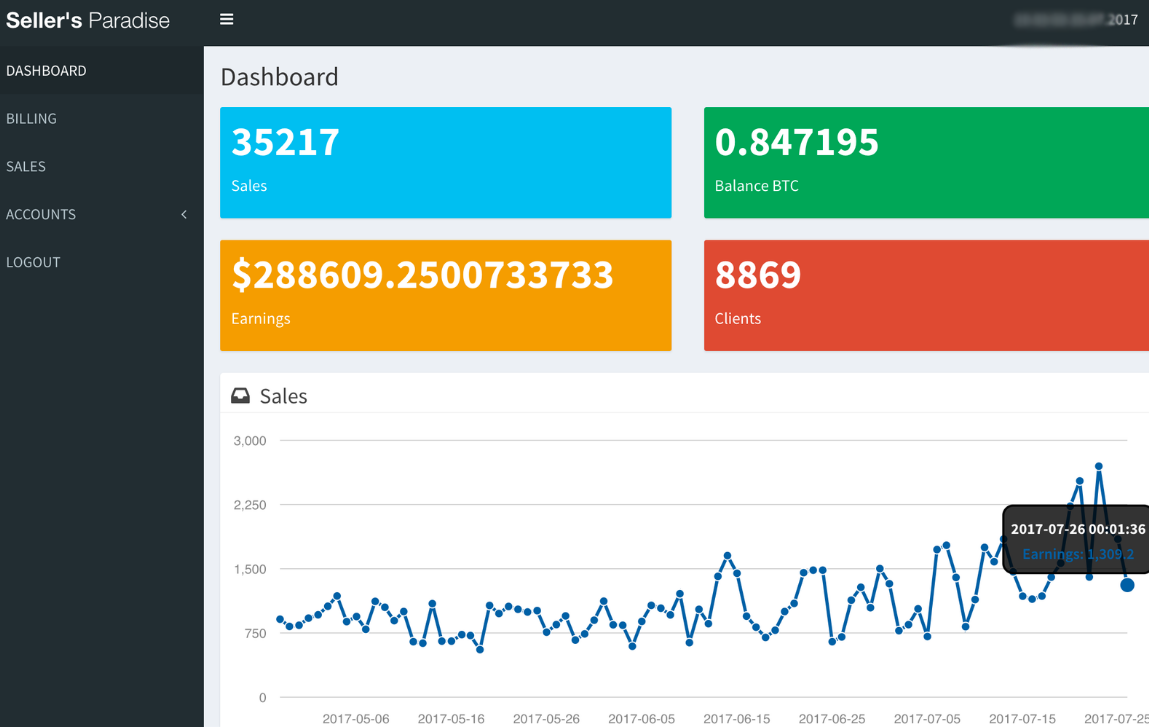

This past year KrebsOnSecurity published nearly 160 stories, generating more than 11,000 reader comments. The pace of publications here slowed down in 2017, but then again I have been trying to focus on quality over quantity, and many of these stories took weeks or months to report and write.

This past year KrebsOnSecurity published nearly 160 stories, generating more than 11,000 reader comments. The pace of publications here slowed down in 2017, but then again I have been trying to focus on quality over quantity, and many of these stories took weeks or months to report and write.

The December patch batch addresses more than 30 vulnerabilities in Windows and related software. As per usual, a huge chunk of the updates from Microsoft tackle security problems with the Web browsers built into Windows.

The December patch batch addresses more than 30 vulnerabilities in Windows and related software. As per usual, a huge chunk of the updates from Microsoft tackle security problems with the Web browsers built into Windows. The newest Flash update from Adobe brings the player to v. 28.0.0.126 on Windows, Macintosh, Linux and Chrome OS. Windows users who browse the Web with anything other than Internet Explorer may need to apply the Flash patch twice, once with IE and again using the alternative browser (Firefox, Opera, e.g.).

The newest Flash update from Adobe brings the player to v. 28.0.0.126 on Windows, Macintosh, Linux and Chrome OS. Windows users who browse the Web with anything other than Internet Explorer may need to apply the Flash patch twice, once with IE and again using the alternative browser (Firefox, Opera, e.g.).