This week marks the 50th anniversary of the automated teller machine — better known to most people as the ATM or cash machine. Thanks to the myriad methods thieves have devised to fleece unsuspecting cash machine users over the years, there are now more ways than ever to get ripped off at the ATM. Think you’re good at spotting the various scams? A newly released ATM fraud inspection guide may help you test your knowledge.

The first cash machine opened for business on June 27, 1967 at a Barclays bank branch in Enfield, north London, but ATM transactions back then didn’t remotely resemble the way ATMs work today.

The first ATM was installed in Enfield, in North London, on June 27, 1967. Image: Barclays Bank.

The cash machines of 1967 relied not on plastic cards but instead on paper checks that the bank would send to customers in the mail. Customers would take those checks — which had little punched-card holes printed across the surface — and feed them into the ATM, which would then validate the checks and dispense a small amount of cash.

This week, Barclay’s turned the ATM at the same location into a gold color to mark its golden anniversary, dressing the machine with velvet ropes and a red carpet leading up to the machine’s PIN pad.

The location of the world’s first ATM, turned to gold and commemorated with a plaque to mark the cash machine’s golden anniversary. Image: Barclays Bank.

Chances are, the users of that gold ATM have little to worry about from skimmer scammers. But the rest of us practically need a skimming-specific dictionary to keep up with today’s increasingly ingenious thieves.

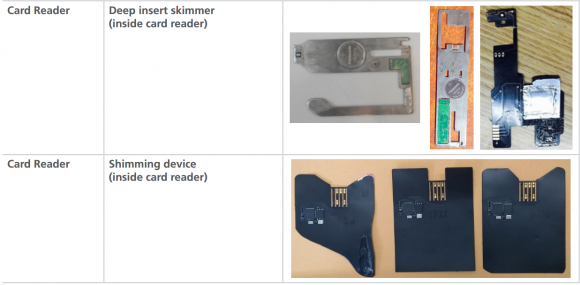

These days there are an estimated three million ATMs around the globe, and a seemingly endless stream of innovative criminal skimming devices has introduced us over the years to a range of terms specific to cash machine scams like wiretapping, eavesdropping, card-trapping, cash-trapping, false fascias, shimming, black box attacks, bladder bombs (pump skimmers), gas attacks, and deep insert skimmers.

Think you’ve got what it takes to spot the telltale signs of a skimmer? Then have a look at the ATM Fraud Inspection Guide (PDF) from cash machine giant NCR Corp., which briefly touches on the most common forms of ATM skimming and their telltale signs.

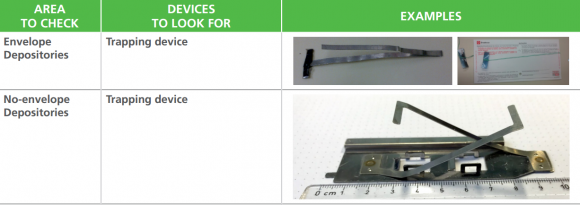

For example, below are a few snippets from that guide showing different cash trapping devices made to siphon bills being dispensed from the ATM.

Cash-trapping devices. Source: NCR.

As sophisticated as many modern ATM skimmers may be, most of them can still be foiled by ATM customers simply covering the PIN pad with their hands while entering their PIN (the rare exceptions here involve expensive, complex fraud devices called “PIN pad overlays”).

The proliferation of skimming devices can make a trip to any ATM seem like a stressful experience, but keep in mind that skimmers aren’t the only thing that can go wrong at an ATM. It’s a good idea to visit only ATMs that are in well-lit and public areas, and to be aware of your surroundings as you approach the cash machine. If you visit a cash machine that looks strange, tampered with, or out of place, then try to find another ATM.

You are far more likely to encounter ATM skimmers over the weekend when the bank is closed (skimmer thieves especially favor long holiday weekends when the banks are closed on Monday). Also, if you have the choice between a stand-alone, free-standing ATM and one that is installed at a fixed location (particularly a bank) opt for the fixed-location machine, which is typically more secure against physical tampering.

“Deep insert” skimmers, top. Below, ATM “shimming” devices. Source: NCR.

from

https://krebsonsecurity.com/2017/06/so-you-think-you-can-spot-a-skimmer/

No comments:

Post a Comment