KrebsOnSecurity has long warned readers to plant your own flag at the my Social Security online portal of the U.S. Social Security Administration (SSA) — even if you are not yet drawing benefits from the agency — because identity thieves have been registering accounts in peoples’ names and siphoning retirement and/or disability funds. This is the story of a Midwest couple that took all the right precautions and still got hit by ID thieves who impersonated them to the SSA directly over the phone.

In mid-December 2017 this author heard from Ed Eckenstein, a longtime reader in Oklahoma whose wife Ruth had just received a snail mail letter from the SSA about successfully applying to withdraw benefits. The letter confirmed she’d requested a one-time transfer of more than $11,000 from her SSA account. The couple said they were perplexed because both previously had taken my advice and registered accounts with MySocialSecurity, even though Ruth had not yet chosen to start receiving SSA benefits.

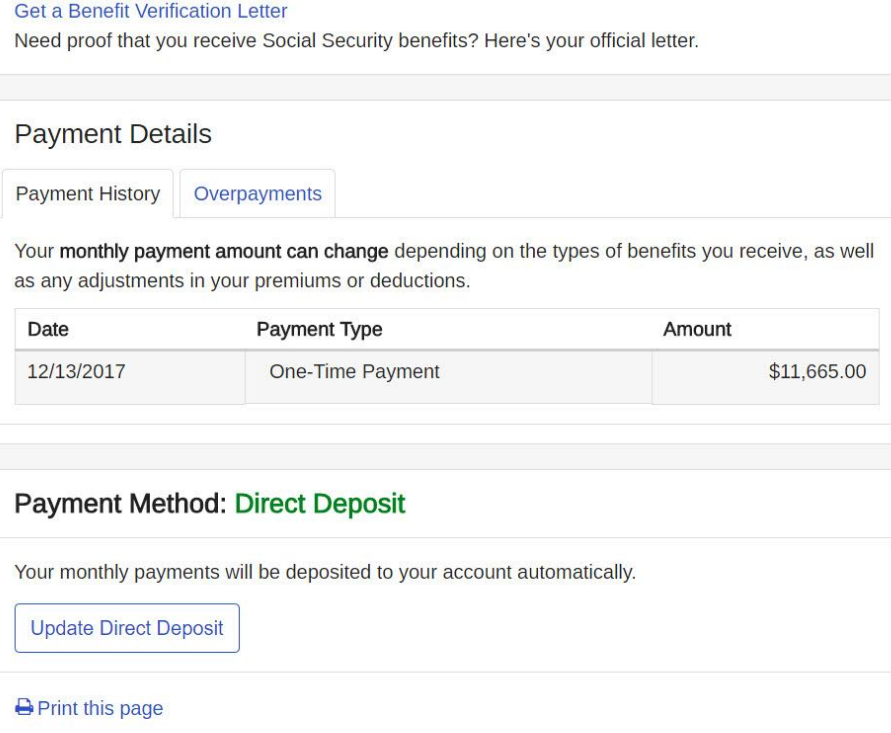

The fraudulent one-time payment that scammers tried to siphon from Ruth Eckenstein’s Social Security account.

Sure enough, when Ruth logged into her MySocialSecurity account online, there was a pending $11,665 withdrawal destined to be deposited into a Green Dot prepaid debit card account (funds deposited onto a Green Dot card can be spent like cash at any store that accepts credit or debit cards). The $11,655 amount was available for a one-time transfer because it was intended to retroactively cover monthly retirement payments back to her 65th birthday.

The letter the Eckensteins received from the SSA indicated that the benefits had been requested over the phone, meaning the crook(s) had called the SSA pretending to be Ruth and supplied them with enough information about her to enroll her to begin receiving benefits. Ed said he and his wife immediately called the SSA to notify them of fraudulent enrollment and pending withdrawal, and they were instructed to appear in person at an SSA office in Oklahoma City.

The SSA ultimately put a hold on the fraudulent $11,665 transfer, but Ed said it took more than four hours at the SSA office to sort it all out. Mr. Eckenstein said the agency also informed them that the thieves had signed his wife up for disability payments. In addition, her profile at the SSA had been changed to include a phone number in the 786 area code (Miami, Fla.).

“They didn’t change the physical address perhaps thinking that would trigger a letter to be sent to us,” Ed explained.

Thankfully, the SSA sent a letter anyway. Ed said many additional hours spent researching the matter with SSA personnel revealed that in order to open the claim on Ruth’s retirement benefits, the thieves had to supply the SSA with a short list of static identifiers about her, including her birthday, place of birth, mother’s maiden name, current address and phone number.

Unfortunately, most (if not all) of this data is available on a broad swath of the American populace for free online (think Zillow, Ancestry.com, Facebook, etc.) or else for sale in the cybercrime underground for about the cost of a latte at Starbucks.

The Eckensteins thought the matter had been resolved until Jan. 14, when Ruth received a 1099 form from the SSA indicating they’d reported to the IRS that she had in fact received an $11,665 payment.

“We’ve emailed our tax guy for guidance on how to deal with this on our taxes,” Mr. Eckenstein wrote in an email to KrebsOnSecurity. “My wife logged into SSA portal and there was a note indicating that corrected/updated 1099s would be available at the end of the month. She’s not sure whether that message was specific to her or whether everyone’s seeing that.”

NOT SMALL IF IT HAPPENS TO YOU

Identity thieves have been exploiting authentication weaknesses to divert retirement account funds almost since the SSA launched its portal eight years ago. But the crime really picked up in 2013, around the same time KrebsOnSecurity first began warning readers to register their own accounts at the MySSA portal. That uptick coincided with a move by the U.S. Treasury to start requiring that all beneficiaries receive payments through direct deposit (though the SSA says paper checks are still available to some beneficiaries under limited circumstances).

More than 34 million Americans now conduct business with the Social Security Administration (SSA) online. A story this week from Reuters says the SSA doesn’t track data on the prevalence of identity theft. Nevertheless, the agency assured the news outlet that its anti-fraud efforts have made the problem “very rare.”

But Reuters notes that a 2015 investigation by the SSA’s Office of Inspector General investigation identified more than 30,000 suspicious MySSA registrations, and more than 58,000 allegations of fraud related to MySSA accounts from February 2013 to February 2016.

“Those figures are small in the context of overall MySSA activity – but it will not seem small if it happens to you,” writes Mark Miller for Reuters.

The SSA has not yet responded to a request for comment.

Ed and Ruth’s experience notwithstanding, it’s still a good idea to set up a MySSA account — particularly if you or your spouse will be eligible to withdraw benefits soon. The agency has been trying to beef up online authentication for citizens logging into its MySSA portal. Last summer the SSA began requiring all users to enter a username and password in addition to a one-time security code sent their email or phone, although as previously reported here that authentication process could be far more robust.

The Reuters story reminds readers to periodically use the MySSA portal to check and make sure that your personal information – such as date of birth and mailing address – are correct. “For current beneficiaries, if you notice that a monthly payment has not arrived, you should notify the SSA immediately via the agency’s toll-free line (1-800-772-1213) or at your local field office,” Miller advised. “In most cases, the SSA will make you whole if the theft is reported quickly.”

Another option is to use the SSA’s “Block Electronic Access” feature, which blocks any automatic telephone or online access to your Social Security record – including by you (although it’s unclear if blocking access this way would have stopped ID thieves who manage to speak with a live SSA representative). To restore electronic access, you’ll need to contact the Social Security Administration and provide proof of your identity.

from

https://krebsonsecurity.com/2018/01/registered-at-ssa-gov-good-for-you-but-keep-your-guard-up/

No comments:

Post a Comment